income tax calculator usa

Tax Financial News. Ad Need Help With Tax Preparation.

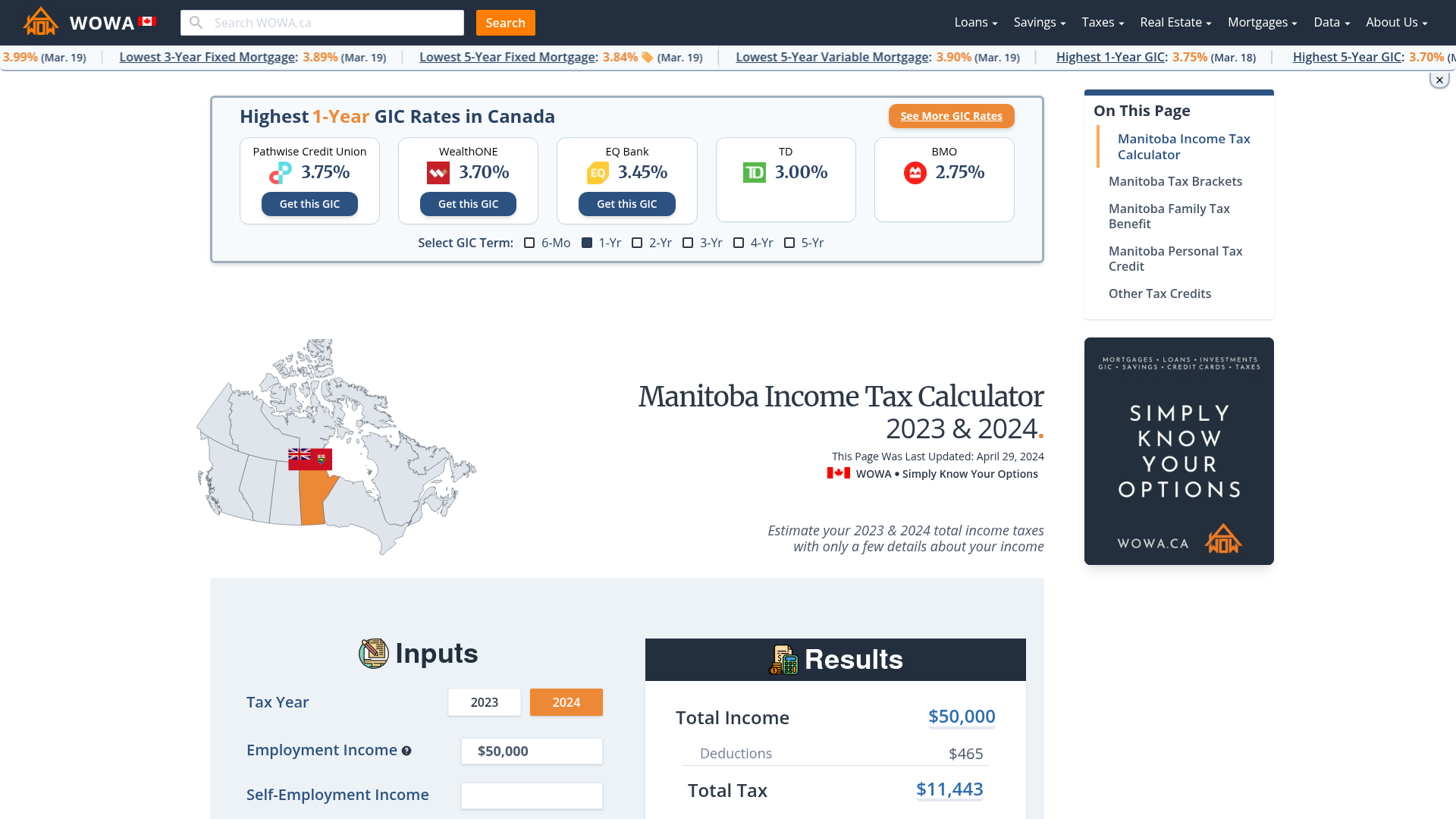

Manitoba Income Tax Calculator Wowa Ca

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. First enter your Gross Salary amount where shown. Calculate your income tax in the United States salary deductions in the United States and compare salary after tax for income earned in the United States in the 2022 tax year using the.

Your average tax rate is. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income. Your household income location filing status and number of personal.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Based on the tax bracket you enter the calculator will also estimate tax as a percentage of your taxable income. Your household income location filing status and number of personal.

Some calculators may use taxable income when calculating the average tax rate. Efile your tax return directly to the IRS. Can be used by salary earners self.

Legacy Tax Resolution Services Is There To Help You. Federal tax rates range from 10 to 37 depending on your income while state. Next select the Filing Status drop down.

This page includes the United States Annual Tax Calculator for 2022 and supporting tax guides which are designed to help you get the most out of the tax calculator. 2021 tax preparation software. Calculator Variables and Results Tax Year.

Choose the year that you want to. Stop The Stress and Resolve Your Problems. US Tax Calculator 2022.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Youll then get a breakdown of your total tax liability and take-home. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

The personal income tax rate in the US is progressive and assessed both on the federal level and the state level. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The proposed one-time income tax rebates would equal approximately 500 million and see Idahoans get back 10 of their 2020 taxes paid with minimum rebates of 300.

Income Tax Calculator USA United States of America calculates federal taxes for year 2019 2018. Ad Need Help With Tax Preparation. Using the United States Tax Calculator is fairly simple.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. This Income Tax Calculator is updated for according to November 2018 Tax. Prepare federal and state income taxes online.

Your household income location filing status and number of personal. US Income Tax Calculator 2022. See where that hard-earned money goes - with Federal Income.

Stop The Stress and Resolve Your Problems. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Using the United States Tax Calculator. Legacy Tax Resolution Services Is There To Help You. That means that your net pay will be 43041 per year or 3587 per month.

Low-income borrowers who went to college on Pell Grants will receive up to 20000 in student loan forgiveness. 100 Accurate Calculations Guaranteed. This debt relief will give tens of millions of borrowers some.

ATL - Lates Tax Financial News Updates. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 100 Free Tax Filing.

Taxable income 87450 Effective tax rate 172. Try Our Free And Simple Tax Refund Calculator.

Personal Income Tax Solution For Expatriates Mercer

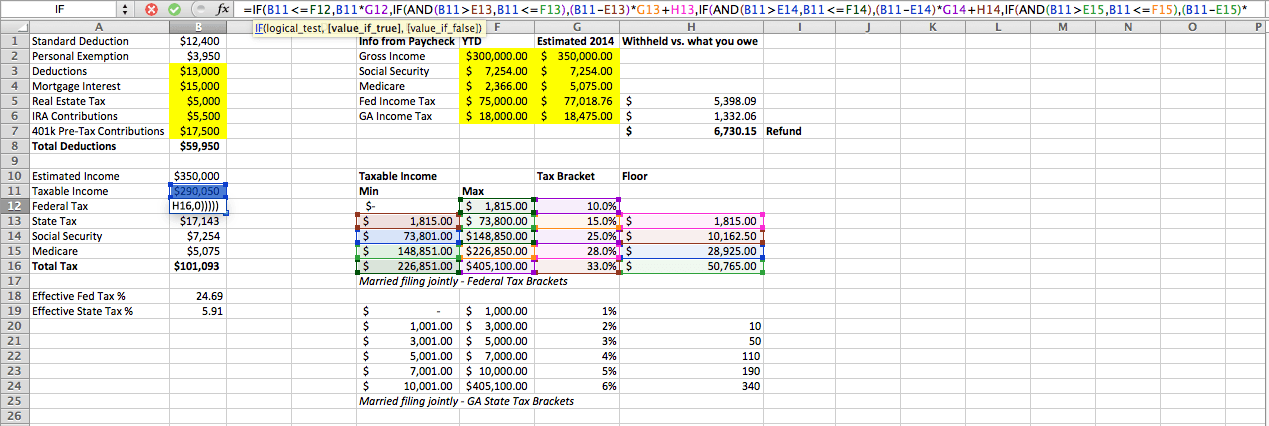

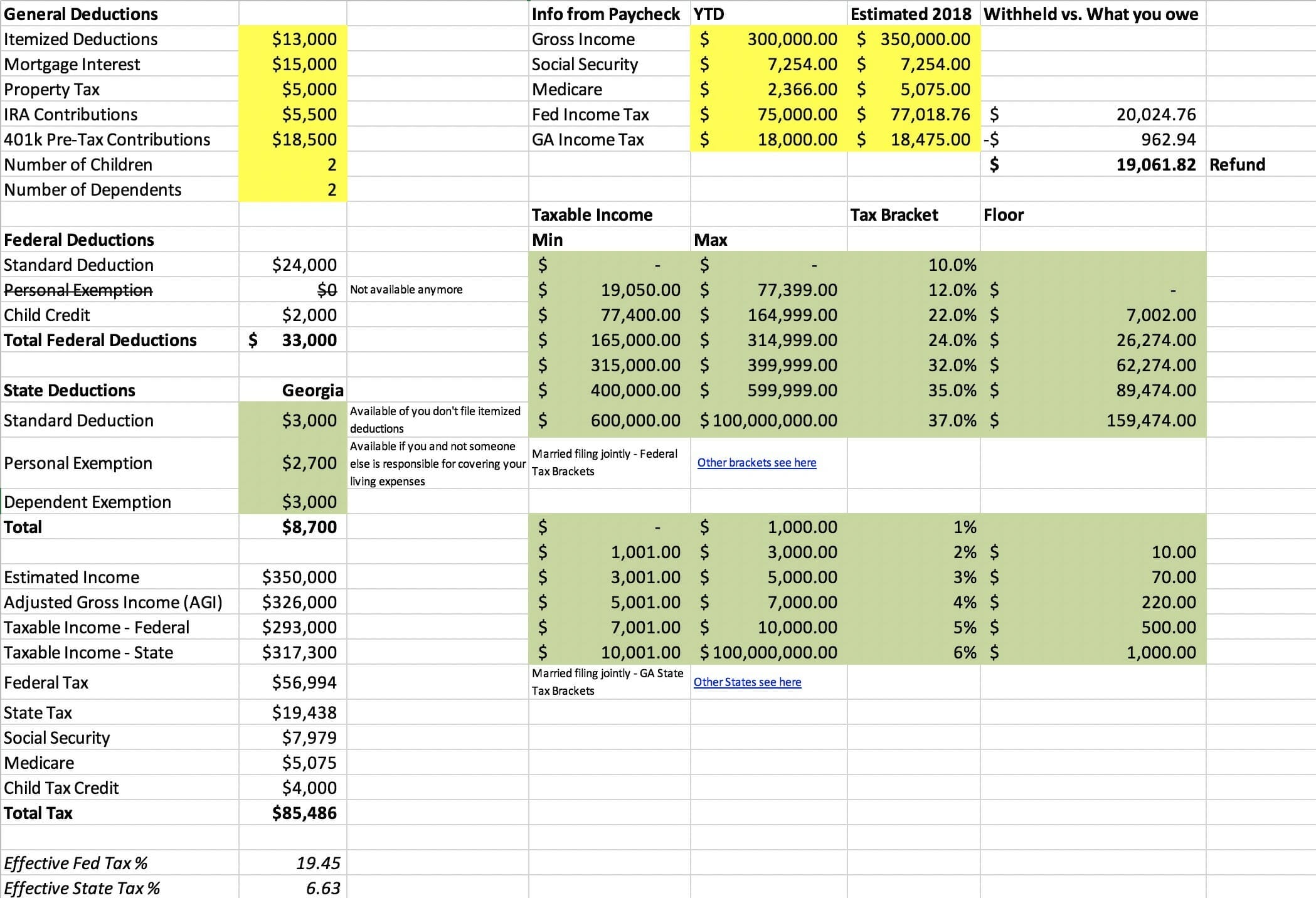

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Us Tax Calculator Sale Online 55 Off Www Ipecal Edu Mx

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

When Are Taxes Due In 2022 Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Personal Income Tax Solution For Expatriates Mercer

2022 2023 Tax Brackets Rates For Each Income Level

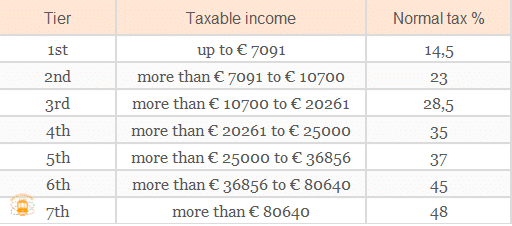

Taxes In Portugal Discover Everything You Need To Know Go To Portugal

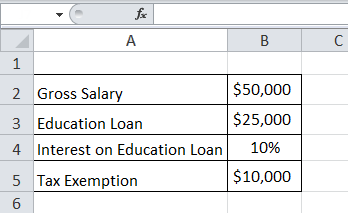

Taxable Income Formula Examples How To Calculate Taxable Income

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Here S How Much Money You Take Home From A 75 000 Salary

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download